Scandalous! I know – my grandmother, god rest her soul, constantly asked in a slightly horrified tone “what will people think?” for two years until we eventually got engaged. Not only did we move in together, but we actually bought the place. By her standards, we had not earned the rite of passage into homeownership by skipping the whole marriage bit. Though our decision to buy may have gone against her traditional view of a “normal” life trajectory, we joined the 24% of unmarried couples taking the leap into home ownership.

This number will continue to rise as attitudes shift in favor of couples living together before marriage. In fact, a MONEY magazine readership poll revealed that 40% of millennials think that it’s a good idea to buy a home together before marriage. While there are many reasons why couples choose this non-traditional path, the key ones are financial. It was no different in our case. Here’s a short list of reasons why a couple might be eager to enter into homeownership:

-

- Marriage has become a to-do for later in life, or never. Committed couples who have successfully lived together are ready to stop paying rent and start building their own wealth.

- Low Interest Rates. Mortgage rates are still fairly low, which makes purchasing more affordable and entices buyers to lock in a good rate while they can.

- Tax advantages. Homeowners are able to take advantage of mortgage interest and property tax deductions among other benefits like deducting a portion of capital gains from their taxable income if they end up selling the house.

- It’s more affordable. Going halfsies might be the only way that you can afford to buy in more expensive areas.

- Weddings are expensive. Today, the average wedding costs around $32k, not including a honeymoon. Couples who have worked hard to save this amount of money are choosing to invest in assets that will build equity over the long-term, rather than spending it on a 5-hour party.

While there are undeniably great benefits to putting the mortgage before the marriage, it’s not something you should consider pursuing lightly. Sealing the deal on a mortgage is almost as big, or dare I say it, an even bigger commitment than actually getting married. Getting out of a co-ownership can be very tricky and marriage may offer certain protections should something go awry. If you’ve given it some thought and are determined to head off on this adventure together, here are some question prompts that will help you succeed.

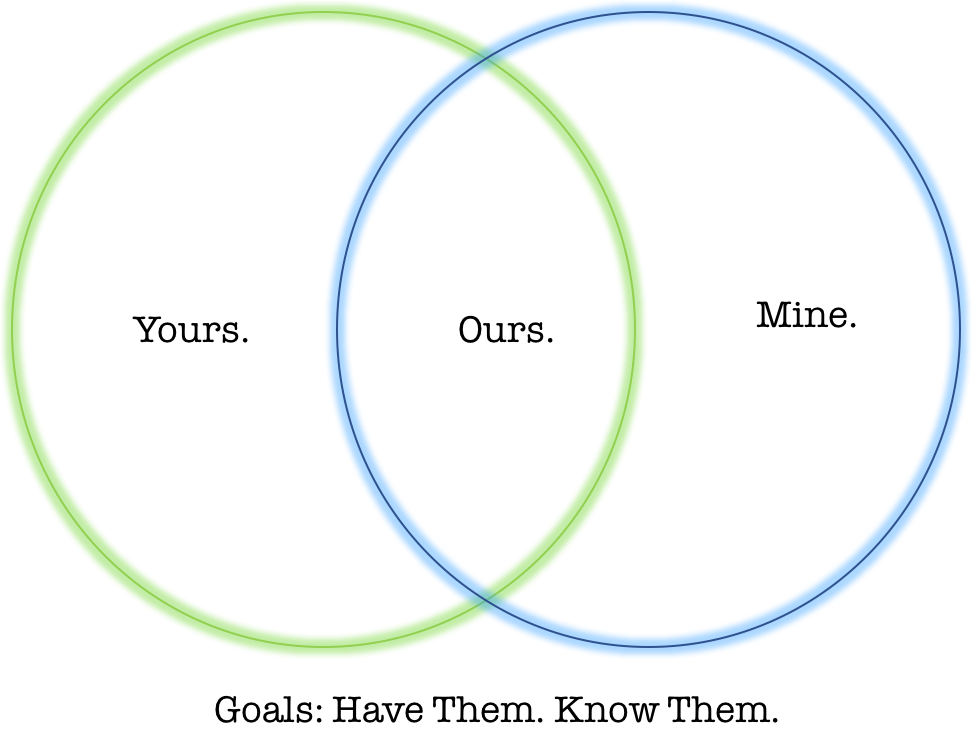

1. Are your goals in alignment?

You know those silly, “where do you see yourself in 5-10 years” interview questions? Well, now’s the perfect time to figure out some realistic answers. While you might not plan on living in this property forever, or even at all if you’re going the income property, or flipper route, you’ll want to set yourselves up for success.

Reflect on your relationship – particularly it’s length, maturity and your past experiences of working through stressors and challenges. Figure out the needs that must be met on both ends to ensure continued success and satisfaction in the relationship. It’s also a great time to figure out if you’re actually in this for the long haul.

Reflect on your life goals – make sure to discuss goals related to finances, career, family, personal hobbies, etc. and consider how the purchase of property might impact each set.

Reflect on your finances – Now’s not the time to hide bad credit scores, or debts from your significant other. Be 100% upfront about both of your financial situations. If you haven’t already, start trying to manage a budget together before making such a huge purchase together. Also be sure to discuss whether or not you can still afford the mortgage payments should one of you lose a job, or other source of income.

Reflect on property types – a condo may be the most affordable and least work; a single family with a backyard is going to need extra time and money spent on maintenance; multi-families will require maintenance along with some business acumen to get the most value out of the property. Thinking about flipping? You’re going to need an aligned vision, some construction knowledge or willingness to learn, and a lot of patience. There are pros and cons to each – it’s up to you to figure out exactly what you’re willing to take on and the challenges you’re realistically able to tackle.

Be honest, listen to each other’s answers and don’t shy away from tough conversations – you never know what you might discover!

2. How will you protect your investment and each other?

Sure, we all aim for the best, but the reality is that life sometimes gets in the way of those plans. Chances are this is the biggest purchase the two of you have made together, let alone as individuals. For that reason, it’s crucial to have a solid plan in place to protect your investment and finances in the event that you hit some bumps in the road.

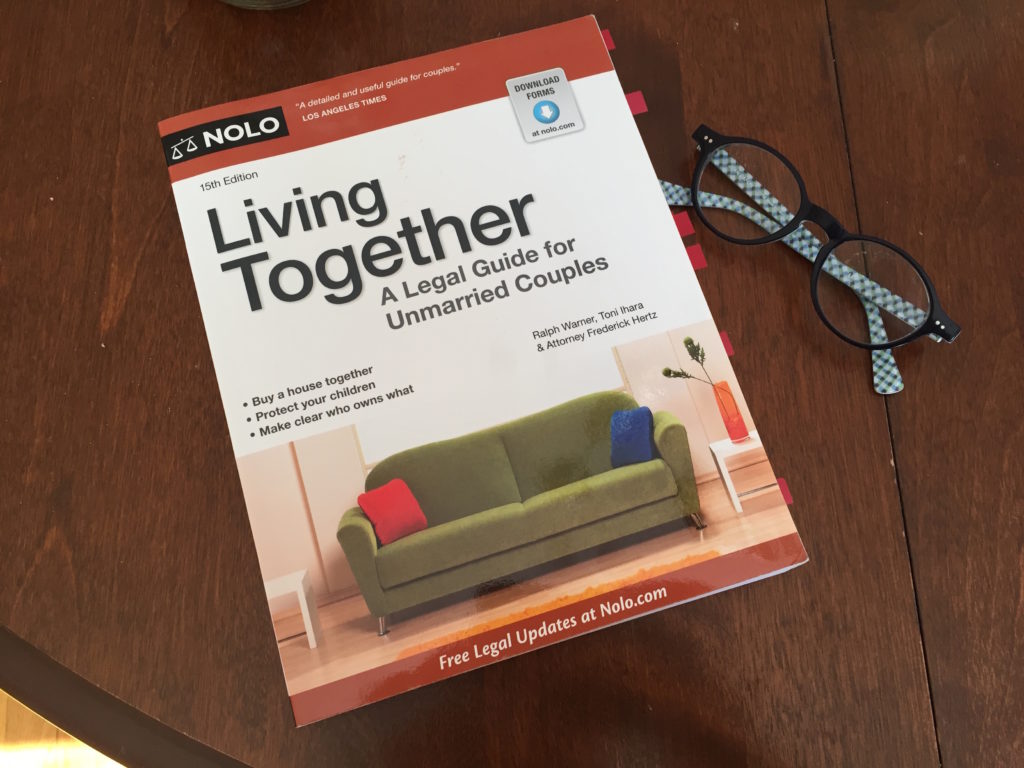

Break Ups – 27% of unmarried couples who live together end up dissolving the relationship within 3 years. No matter how strong your relationship may be, draft an agreement outlining how you will handle the property and who gets what in terms of property rights should the relationship end. We found the resources and templates in Nolo’s Living Together, A Legal Guide for Unmarried Couples very helpful. Once it’s drafted, it wouldn’t hurt to have a lawyer take a peek.

Loss of Income – Wether it be a job loss, career shift, or other unexpected event, make sure that at least one of you will be able to continue to cover the mortgage payments. Having an emergency plan in place will help you keep the property you worked so hard to buy and avoid damaging your credit.

Serious Injury or Death– It’s an uncomfortable topic to talk about, but an important one. This purchase is one of the first steps in building out your life together and part of that includes establishing safety nets not only for yourselves as individuals, but for one another. You may want to consider creating a Will that includes your wishes for how the property and any other possessions you own will be passed on to survivors, particularly your partner. Additionally, you may want to consider adding your significant other as a beneficiary on life insurance, your 401k and other bank accounts. The last thing you’d want is for your partner to have to struggle financially and/or potentially lose the house.

3. How will you take ownership?

Before the final paperwork is drafted, you’ll need to decide how you’ll take ownership. Differences in ownership determine how the interest in the property is divided as well as rights of survivorship. Be sure to discuss pros and cons of each with an attorney. Unmarried couples have three options:

Tenancy In Common – As Tenants in Common, each owner gets a specified share of the property. This type of ownership allows for flexibility in terms of how the interest in the property is divided – it doesn’t have to be 50/50. It might be useful to take title this way if you don’t plan on contributing equally toward the purchase of the property. Along the same lines, co-owners are able to sell, or pass on his or her share on to any beneficiary he or she chooses. Be sure to have estate planning docs in place outlining exactly what you want to happen with the property should anything happen, or it could result in a long, arduous probate process.

Joint Tenants – As joint tenants, ownership is shared equally and undivided. Interest in the property cannot be sold without the other owner’s consent. Unlike Tenancy in Common, a joint tenancy creates a Rights of Survivorship. That means that one partner’s half of the property will automatically transfer to the other upon death. Joint tenancy helps avoid probate and the time and costs that go along with it.

Sole Ownership – You’re probably wondering why this is on here if you’re buying together. In some cases, it might be best if one person buys the house. You might consider this if the relationship is relatively new, or one of you has less than perfect credit, etc. Just be sure that the name(s) on the mortgage match the name(s) on the title – you don’t want to assume liability for the loan without having the collateral to back it. It’s easy enough to add a name to a title later on if you choose this path.

Taking the leap into homeownership was one of the best decisions we’ve made and I hope this will help others join in that feeling. To all the unmarried couples out there who’ve done it, what was your experience like?